Fair Isaac corporation (FICO)

I designed this asynchronous linear eLearning project for financially illiterate adults. Learners can review the content and assess what they learned. The learning experience increases financial literacy and credit scores.

Overview

Audience: FICO Score Illiterate

Responsibilities: Instructional Design, eLearning Development, Visual Design, Subject Matter Expertise

Tools Used: Articulate Storyline 360, BG Remover, Microsoft Word, Google Suite, ChatGPT, MindMeister, Accessible Color Palette Builder; Coblis; Contrast Checker; Snip & Sketch

This project came out of a needs assessment from a graduate project I completed a year prior. A survey of friends and associates determined that many of them didn’t know much about FICO scores and their impact.

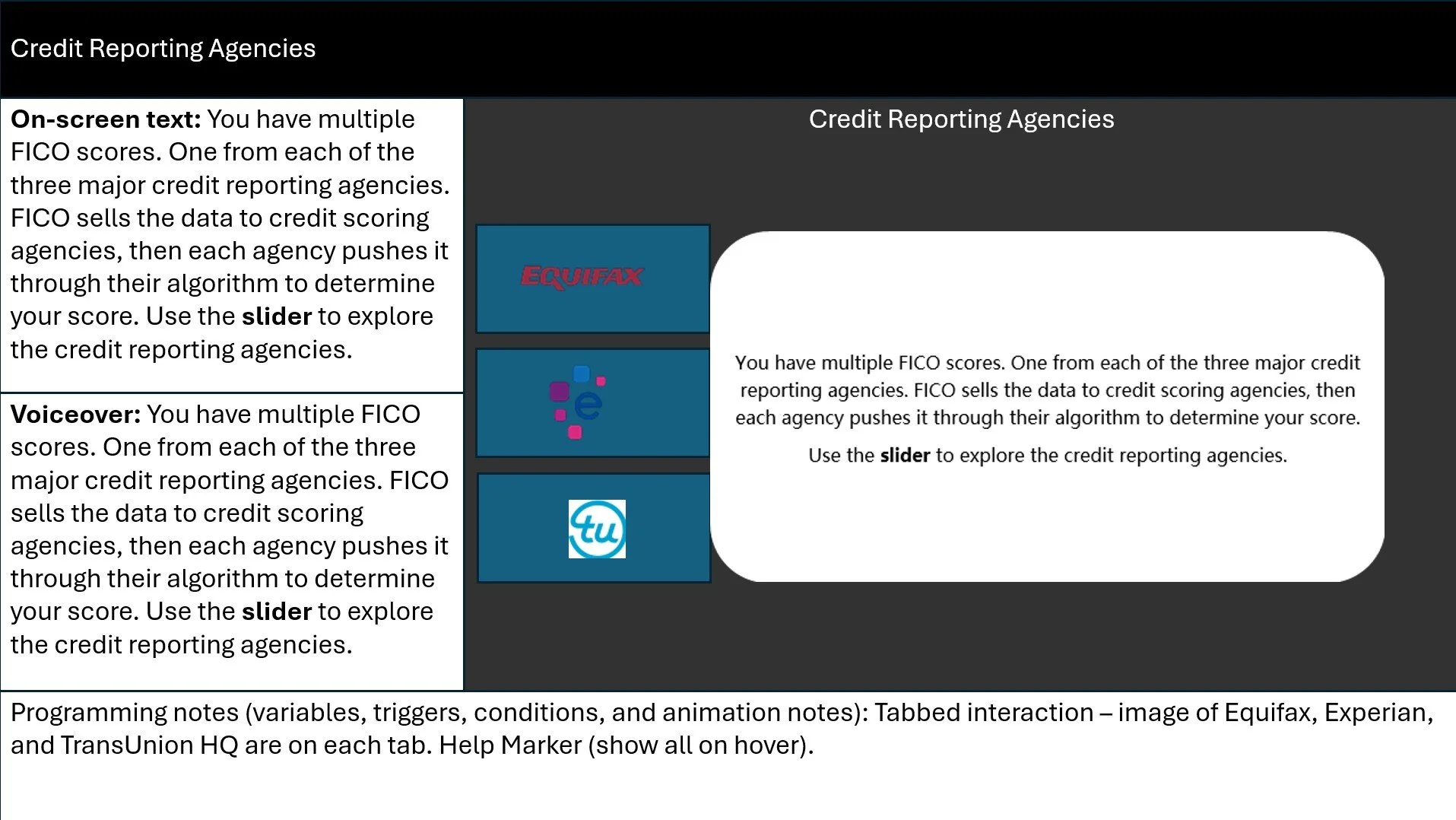

The performance gap was in the breakdown of the score and what the three digit number represented. The audience lacked the knowledge to articulate what the FICO score was. They could not identify nor understand the role of the three major credit reporting agencies. The audience lacked details on how to improve FICO scores. The audience could not explain how FICO scores applied to them.

The issue was leading to poor understanding of the economy and poor decisions when considering big ticket purchases.

My goal was to improve FICO score literacy by providing them a risk-free environment to learn about FICO and its applications.

My Process

After going through my old surveys and a few face-to-face conversations with friends, I determined the knowledge gap is a misunderstanding of FICO and its relationship with credit reporting agencies. Additionally, there is a misunderstanding of the internal composition of a credit score.

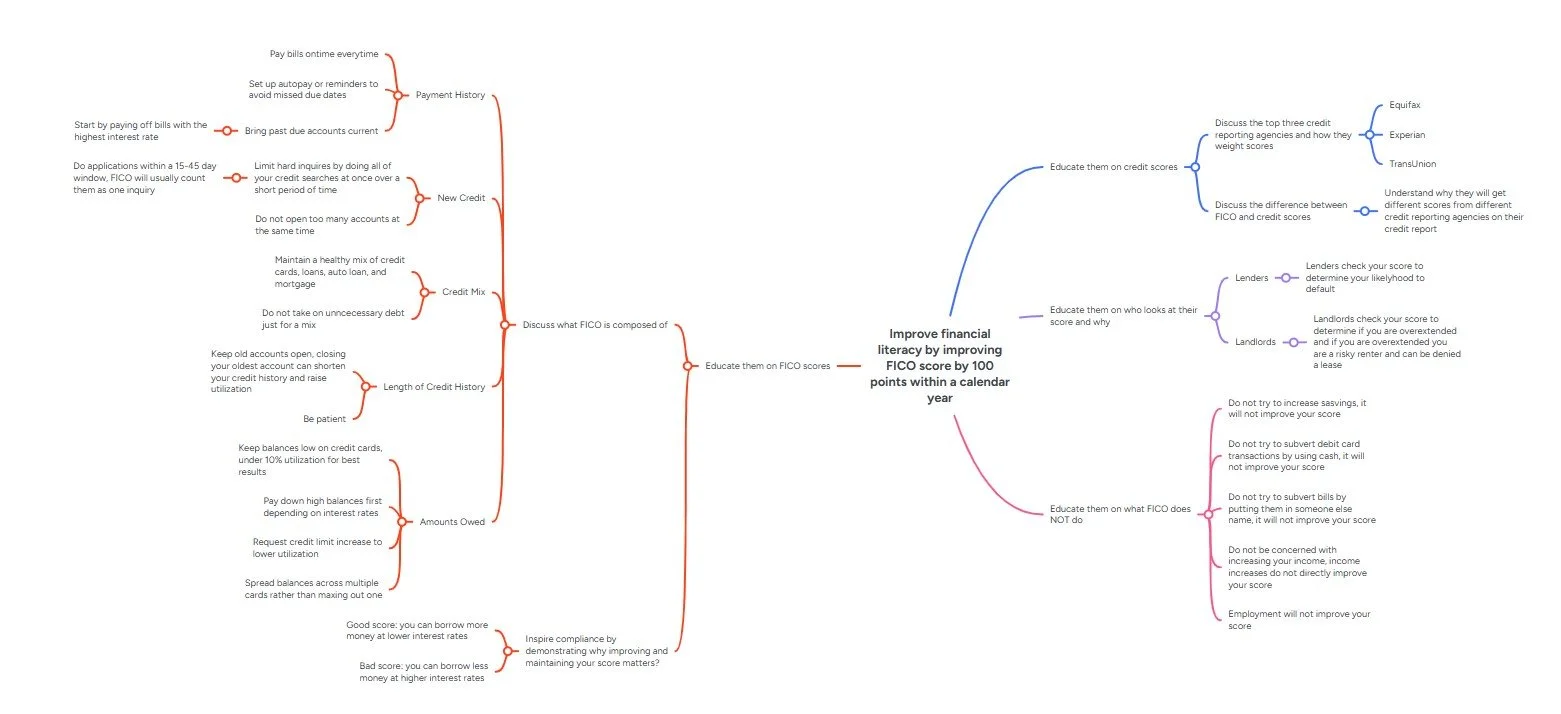

I determined a measurable goal and used MindMeister to action map what I wanted to achieve out of this learning experience.

I used Microsoft Word to create the script then pasted the script into PowerPoint to visually storyboard the information I was aggregating from numerous websites and YouTube videos. I used ChatGPT to discover new resources, and this helped me overcome some of my blind spots.

I designed and developed an interactive linear eLearning experience with Articulate Storyline 360. This learning experience helps educate the audience on the relationship between FICO and credit reporting agencies and the internal composition of a credit score. The goal is to improve their FICO score by providing them with the tools and knowledge to perform financially. The eLearning is a beginner’s guide with numerous “jumping off” points for the learner to dig deeper into this topic.

Action Mapping

For this project I used an extensive amount of references and my own subject matter expertise to develop an action map and define a measurable goal. The goal was to improve financial literacy by improving FICO scores.

Visual Storyboard

508 compliance

508 compliance refers to a section of the U.S. Rehabilitation Act that mandates federal agencies make all their electronic and information technology accessible to people with disabilities. This law ensures that disabled employees and the public have equal and comparable access to information and data provided by the government through accessible technology. Studying up on these compliances was a labor of love.

Here is how 508 compliance is integrated into this learning experience:

Audio provided for all text

Alt text for all images

A minimum 4.5:1 contrast ratio for normal text

A minimum 3.0:1 contrast ratio for large text

A minimum 3.0:1 contrast ratio for graphic objects

Left to right, top down focus order for screen readers

Keyboard only navigation including navigation menu

Color blind sensitive navigation

Closed captions

Learner controlled audio

Results and Take aways

I got a lot of joy out of building this eLearning experience. When I was a financial specialist and was creating budgets for my clients, I sometimes struggled to convey how important a person’s credit score was and how their current spending contributed to their credit score. A lot of people were never taught how to maximize their credit scores. So far, users have enjoyed testing their new knowledge and have also learned a few new factoids!

My biggest takeaway from designing this project was how important it is to continue iterating. I have gone over this learning experience numerous times, and every time I find a new item to update or make better in some way. I also try to keep accessibility in mind as I conceptualize learning experiences. I went back and updated this project to be 508 compliant and learned so much in the process.